MORTGAGE GLOSSARY TERMS

MORTGAGE DEFINITIONS DICTIONARY

Below you will find an extensive list of mortgage glossary terms and a mortgage definitions dictionary. Learning mortgage terminology will help you pass the NMLS exam with confidence. Our online SAFE MLO exam prep has helped thousands of test-takers pass their mortgage loan originator examination!

Pass The NMLS Test - START NOW!

Our program comes with 1,000 mortgage test questions with detailed answer explanations updated for 2025 rules and regulations. You will also get access to mortgage term flashcards, 50 additional MLO math prep test questions, mortgage exam prep videos, and reliable support from an expert mortgage instructor.

OUR SAFE MLO EXAM PREP INCLUDES...

"I passed the NMLS exam on my first try..."

Pass your NMLS exam guaranteed! Our mortgage exam prep has helped thousands of test-takers pass their mortgage loan originator exam. Our MLO exam prep comes with 1,000 mortgage test questions up to date with the latest 2025 rules and regulations, 50 additional mortgage math questions, NMLS test flashcards, NMLS exam prep tip videos, and reliable support from an expert mortgage instructor.

Our SAFE MLO Exam Prep Covers: Federal Mortgage-Related Laws, General Mortgage Knowledge, Mortgage Loan Origination Activities, Ethics, and Uniform State Content.

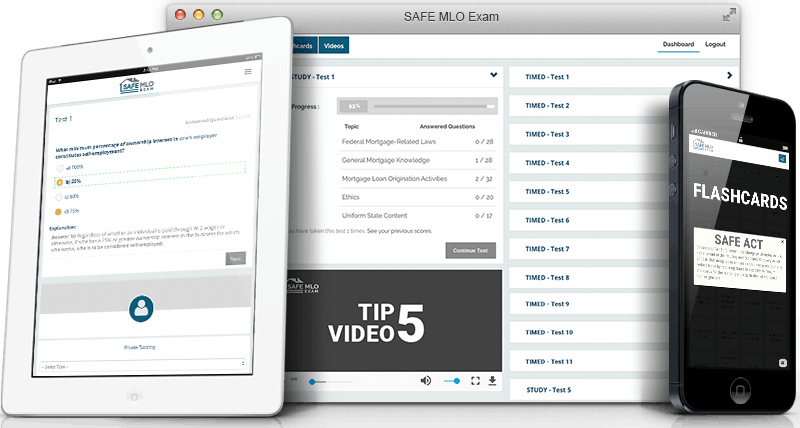

Study For Your NMLS Test On Any Device

1,000 NMLS Practice Test Questions

8 Mortgage Tests & NMLS Exam Vocabulary Flashcards

50 Additional MLO Math Practice Questions

All Mortgage Math Topics Will Be Covered

User Friendly Dashboard On All Devices

Take Exams in Practice Mode, or Live Exam Mode!

Facebook Support Group

Q&A With Expert Mortgage Teacher